The United Arab Emirates is using its vast oil money to buy up the rights to land in many African countries to sell carbon credits to major polluters.

In 2022, a member of the UAE royal family set up a private investment company called Blue Carbon to facilitate the deals.

Blue Carbon lacks experience in managing carbon offset projects. The company is led by Sheikh Ahmed Dalmook Al Maktoum, who has close connections to the UAE royal family, a significant player in the oil and gas industry. This has raised concerns that Blue Carbon’s contracts could potentially be used to offset the emissions of the United Arab Emirates.

The company is negotiating to purchase the rights to about a tenth of Liberia’s land mass, a fifth of Zimbabwe’s, and swaths of Kenya, Zambia and Tanzania. The deal involves land about the size of the United Kingdom. Blue Carbon would then sell carbon credits linked to forests preserved on this land.

These agreements collectively result in Blue Carbon gaining significant control over a total land area of 24.5 million hectares, which raises concerns about potential violations of customary land rights held by local communities.

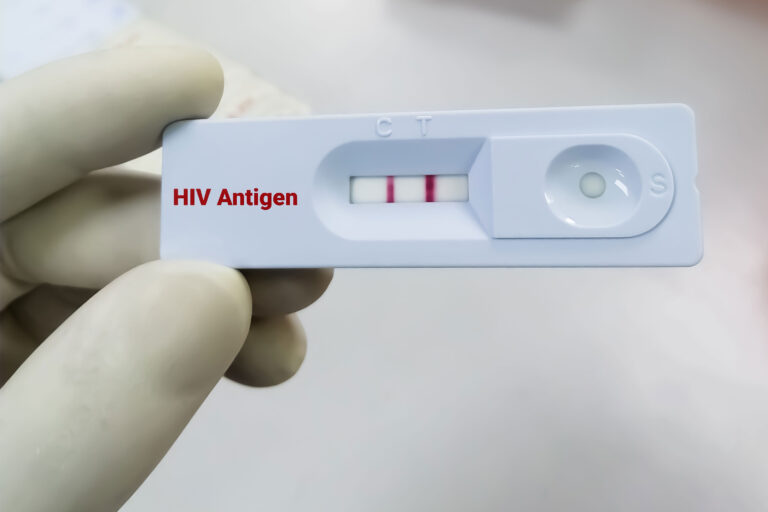

The carbon credit market allows a polluter to emit carbon dioxide or other climate-heating gas and pay a forest owner to capture those emissions through the carbon absorption power of their trees.

Carbon credits enable companies to emit a specific quantity of carbon dioxide or other harmful gases, with one credit representing one ton of emissions. They are typically generated through initiatives like tree planting or the adoption of cleaner cooking fuels.

Supporters of carbon credits argue that they offer a means for companies to achieve carbon-neutral status, while critics view them as potentially granting oil producers a license to continue polluting.

Carbon offsets, distinct from carbon credits, are generated when companies or individuals finance projects aimed at reducing greenhouse gas emissions in other locations.

The world’s poorest continent is also the worst impacted by the extreme events fueled by the warming of the planet, despite having contributed least to climate change.

“After failing to mitigate at the source,” wealthy polluters now “want to buy, on the cheap, African land,” says Power Shift Africa’s Mohamed Adow about wealthy nations’ failure to deliver on climate finance and turn to a “land grab” on the African continent. “What they’re doing is commodifying nature,” says Adow, who describes carbon credits as an “imaginary concept” amounting to “permits to pollute.”

The global voluntary carbon offset market, valued at $2 billion, enables carbon emitters to compensate for their emissions by purchasing credits from projects focused on reducing emissions, primarily in the realm of forest conservation.

Saudi Arabia is becoming an increasingly significant participant in Kenya’s emerging voluntary carbon market. In the previous year’s Future Investment Initiative forum, an auction took place where 1.4 million tons of carbon offsets were traded, with Saudi Aramco, the world’s largest oil producer and a participant in the import credit scheme, serving as the primary purchaser.

Kenya received $13.79 million from 16 Saudi firms, including Aramco and the Saudi Electricity Company, through an auction organized by Saudi Arabia’s Regional Voluntary Carbon Market Company.

The Kenyan government got a loan and has agreed with the International Monetary Fund to increase forest cover and landscapes including water towers.

Forest-based carbon projects are particularly problematic as they often target Indigenous Peoples and their ways of life rather than the true drivers of the climate crisis. While there is mounting evidence that existing offsetting schemes have failed to mitigate against climate change, they have already had a detrimental impact on Indigenous Peoples’ lives and land rights.

Kenya signed agreements that will pave the way for reforestation as well as the production of carbon credits on millions of hectares of land.

These projects, and other moves to expand the carbon credits market in the Global South, are expected to greatly increase the theft of Indigenous peoples’ lands; increase funding for violent fortress conservation projects, and will likely lead to many more waves of evictions.

According to Survival International, Amnesty International and Minority Rights Group, studies have shown that Indigenous Peoples are the best guardians of their lands. The ground-breaking African Court judgement in the Ogiek case confirmed that there is no evidence that the government can conserve biodiversity in the Mau Forest better than the Ogiek is already doing and that conservation cannot be used as an excuse for eviction of Indigenous Peoples from their ancestral lands.

Blue Carbon’s press release does not provide extensive details regarding the terms of these agreements. However, it does emphasize that the collaboration aims to “reduce emissions from various environmental sectors, such as forest areas.” The agreement’s primary objective is to “generate essential climate financing to advance climate change mitigation and adaptation efforts, promote sustainable development, and offer significant support to local communities.”